The NFT bubble appeared to have well and truly burst by late 2023. Trading volumes were down by over 50% from the previous year with various news outlets reporting that up to 95% of NFTs were, in fact, worthless.

Within this context, it seems an odd time to begin looking into detail into the value propositions and proposed regulatory treatment of NFTs – after all, won’t they continue down the path to relative irrelevance and obscurity? To many struggling to understand how a picture of a cartoon ape could be sold for over US$3.4 million this would be the logical next step for the NFT market.

Yet, more and more brands continue to enter the market, and the promise of blockchain technology used for purposes of authentication of digital ownership is an interesting concept, especially with promises of a web3 based environment built around value, rather than information. The debate surrounding the future of NFTs then becomes one that focuses on potential use-cases of this new technology and ways of value-creation.

Bored Ape #8817 | Source: https://blockgeeks.com/5-mostexpensive-bored-ape-yacht-club-nfts/

How policymakers may choose to regulate (or not) NFTs becomes a deciding factor in way consumers and brands interact using the technology. There are many muti-faceted policy considerations:

- Do you regulate them like other cryptoassets?

- Do you bring them within financial services regulations? When is that barrier crossed?

- Do you regulate them like art is regulated?

- Or create a bespoke regulatory framework?

These are some of the questions that Digital Currencies Governance Group (DCGG) and INSEAD Business School set out to investigate in the later stages of 2023 through a series of interviews with regulators, policymakers, and industry leaders across different global locations. This led to the production of a report, launched at the Houses of Parliament in London, United Kingdom, on Wednesday, January 24th, 2024, under the title ‘Regulating NFTs: Striking the Balance between Business Innovation and Risks’.

SO WHAT DID OUR RESEARCH TELL US?

What are NFTs?

NFTs epitomise the convergence of blockchain technology and digital ownership. At their core, NFTs leverage blockchain’s decentralized ledger system, where transactions are recorded across a network of computers, ensuring transparency and immutability. This distributed nature of blockchain eradicates the need for centralised authorities, providing a tamper-proof record of ownership and transaction history. Unlike fungible tokens, like cryptocurrencies, each NFT possesses unique properties, making it distinguishable from others. This uniqueness is vital in various applications, from digital art and collectibles to virtual real estate and in-game items.

NFTs serve not only as digital certificates of ownership but also as vehicles for establishing provenance, authenticity, and scarcity in the digital realm. Moreover, they empower creators to tokenise their work, enabling new monetization avenues and fostering a direct connection between creators and collectors.

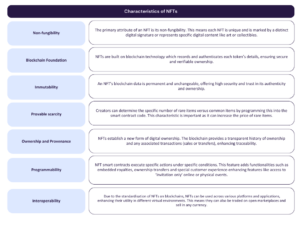

NFT standards & characteristics

The Ethereum blockchain, renowned for its programmability and smart contract capabilities, has emerged as a dominant force in the NFT space. Standards like ERC-721 and ERC-1155 define the technical specifications for NFTs, with ERC-721 ensuring individual distinctiveness and ERC-1155 offering a more versatile framework allowing for fungible, semi-fungible, and non-fungible tokens within one contract. This versatility has sparked innovation, enabling developers to create diverse digital experiences and economies.

OPPORTUNITIES AND RISKS

Opportunities

As the popularity of NFTs continues to soar, it’s important to consider the diverse range of opportunities they offer across multiple industries. NFTs aren’t merely digital collectibles; they represent a groundbreaking innovation with the potential to disrupt traditional markets and unlock new avenues for economic growth. First and foremost, NFTs are revolutionising the carbon market, where they streamline transactions and enhance transparency. By minting carbon credits as NFTs, stakeholders can mitigate risks of duplication and fraud, ultimately bolstering global efforts to combat climate change. In the realm of real estate, NFTs are reshaping property transactions. From fractional ownership to expedited settlements, NFTs offer efficiency and accessibility previously unseen in the industry. By tokenising real estate, NFTs open doors for a broader investor base and reduce unnecessary fees.

NFTs also present unparalleled opportunities for artists and creators. By fractionalising artwork and offering digital ownership, NFTs empower artists to monetise their creations and reach global audiences. This democratisation of the art market fosters new revenue streams and promotes inclusivity in the creative industry. Beyond financial transactions, NFTs provide a secure platform for proving ownership and authenticity. Leveraging blockchain technology, NFTs offer irrefutable proof of ownership and transparent transaction records, instilling trust in digital transactions across various sectors. Furthermore, NFTs are driving social impact through philanthropy and activism. From fundraising for social causes to supporting humanitarian efforts, NFTs provide a novel platform for driving positive change in society.

Risks

As the NFTs market continues to expand, it’s crucial to acknowledge and address the potential risks associated with this burgeoning industry. Market volatility presents a significant challenge, with price fluctuations and sudden market corrections impacting investor confidence and potentially leading to substantial financial losses. Moreover, technological risks, such as vulnerabilities in smart contracts and underlying blockchain infrastructure, underscore the importance of implementing robust security measures and conducting thorough audits to safeguard against potential breaches and cyberattacks.

Additionally, concerns surrounding money laundering and illicit financial activities loom large, as the anonymity afforded by blockchain technology can be exploited by nefarious actors seeking to obscure the origins of illicit funds. Scams further underscore the need for stringent regulatory oversight and consumer protection mechanisms to prevent fraudulent activities and safeguard investor interests. Misleading information and intellectual property concerns add another layer of complexity to the NFT landscape, necessitating clear guidelines, legal frameworks, and enhanced transparency to protect creators’ rights and consumers’ interests. Additionally, addressing blockchain’s environmental impact is crucial for NFT ecosystem sustainability.

Despite these challenges, proactive measures, collaborative efforts, and ongoing dialogue among stakeholders are essential to mitigate risks and foster a safer and more secure environment for all participants in the NFT market.

The adoption of NFTs across various industries brings significant societal benefits and meets diverse consumer demands. Ultimately, by overcoming challenges and leveraging NFT opportunities, the ecosystem has the potential to drive continuous economic growth and reshape digital and physical interactions.

REGULATORY TREATMENT

The rapid rise of emerging technologies such as NFTs poses a unique regulatory challenge, requiring policymakers to balance consumer protection with fostering innovation. Crafting effective regulations necessitates regulatory flexibility and a deep understanding of digital assets and their underlying technology. While NFTs serve as infrastructure for establishing asset provenance and uniqueness, regulators must avoid categorising them as a specific asset class or solely associating them with speculative crypto assets. Scrutinising the characteristics and functions of individual NFTs is essential to determine if existing regulations suffice or if new ones are required, particularly concerning financial services activities.

The distinction between financial and non-financial NFTs is crucial, as certain tokens may resemble financial instruments, potentially triggering stricter authorisation requirements. Discussions also revolve around the need for bespoke regulations to address investor protection and market integrity concerns, especially during periods of market volatility or emerging issues related to intellectual property rights.

The NFT report underscores significant policy considerations and recommendations, particularly in the realm of financial and non-financial services. Here are the key points highlighted:

In financial services:

- Regulators should prioritise developing NFT-specific guidelines to identify characteristics that may classify NFT activities as regulated financial services.

- Policymakers should assess whether existing securities laws are suitable for fungible NFTs (f-NFTs), or if tailored requirements are necessary.

- The fungibility of an NFT should not solely dictate the application of financial services regulations; instead, factors like economic function and utility must be evaluated case by case.

In non-financial services:

- Regulating NFTs as a separate asset class is unnecessary due to their non-fungible nature, thus a case-by-case approach aligning with rules from traditional sectors is recommended.

- Governments should actively monitor NFT marketplaces to comprehend potential intellectual property infringement risks and the effectiveness of industry self-regulation.

- Clarity on the legal status of NFTs and digital assets as property is essential to provide certainty to stakeholders.

- Governments may consider establishing an expert panel to advise on legal and regulatory frameworks for NFTs as the technology evolves.

- Providing guidance on NFT taxation methods and taxable entities can enhance legal certainty in the market.

- Initiating ‘sandbox’ programs can enable experimentation with new NFT technologies and applications, alongside enhancing staff training on NFT products and services.

To present the report’s findings, we organised an event at the UK Parliament on 24th January 2024. We were also delighted to showcase an NFT exhibition at the event, graciously provided by Ledger and Bright Moments. We are grateful to Lord Iain McNicol for hosting the event, which included distinguished speakers such as Peter Zemsky, Frédéric Godart, and Seth Hertlein.

To learn more about NFTs and their proposed regulatory treatment, please read the report in full here or contact [email protected] for further information.