Consultation Summary. For our full response, please head over to our Consultation Responses section.

In February 2023, HM Treasury issued a consultation and call for evidence on the regulatory framework for cryptoassets in the financial services sector. This closed recently with a number of industry stakeholders, including Digital Currencies Governance Group (DCGG), submitting responses.

The consultation solicited feedback on a range of issues, including the best way to adapt existing financial services regulations for cryptoasset activities. While some in the industry had hoped for a more tailored approach like that of the EU’s MiCA or the UK’s Peer-to-Peer lending regime, HM Treasury aims to establish a level playing field with traditional financial services and swiftly bring qualifying cryptoassets within the scope of new rules and requirements (potentially in early 2024).

This will be achieved through expanding the list of Specified Investments under the Financial Services and Markets Act 2000 Regulated Activities Order 2001 (RAO), while also potentially using the new Designated Activities Regime (DAR) for activities that do not fit as neatly within the RAO. Separately, The government has also released the Response to the consultation on cryptoasset promotions, which will bring qualifying cryptoassets within the scope of the restrictions (unless communicated/authorised by an approved person).

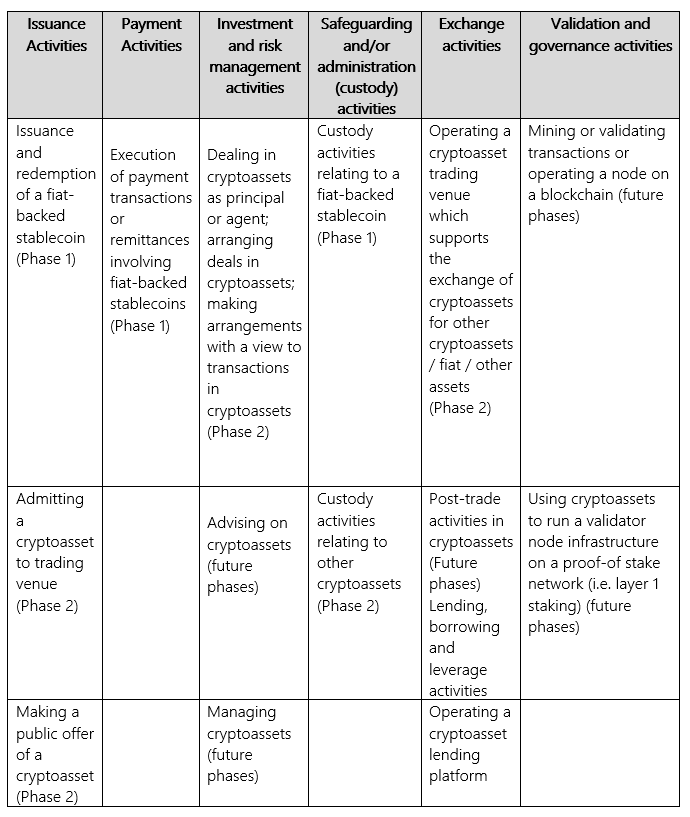

Turning to the consultation itself, HM Treasury proposes a phased approach to bring cryptoasset activities under the regulatory ambit, with priority given to issuance, custody, and payment-related activities of fiat-backed stablecoins used for payments as the core focus of Phase 1. Phase 2 covers a broader set of activities related to other cryptoassets which forms the main focus of the consultation, while additional activities may be included in Phase 3 or in later phases. It is unclear at this stage if a transition period will be established, or how long the gap will be between each phase.

Under the proposed framework, any firm conducting regulated activities in or to the UK will need to be authorised. These location requirements mark a decidedly different approach to the one taken towards traditional financial services, although HM Treasury notes some exemption may apply (e.g., reverse solicitation). The regulatory coverage will also depend on the structure and characteristics of the cryptoasset and whether it falls within financial services regulation (e.g., whether NFTs will be subject to regulation will depend on how they are designed/used to determine whether it will fall under a regulated activity).

The consultation outlines a set of desired outcomes across each regulated activity, focusing on increasing the availability of consumer information and protection through new governance, prudential, and operational resilience requirements. HM Treasury seeks feedback on how much of the existing financial services rulebook can apply to cryptoassets before setting detailed rules.

One significant proposal is a dedicated market abuse regime for cryptoassets based on elements of the MAR for financial instruments. It includes offences covering insider dealing, market manipulation, and unlawful disclosure of inside information. The government intends for these offences to apply to all persons committing market abuse on a cryptoasset, regardless of where the person is based or where the trading takes place. However, HM Treasury acknowledges the challenges of dealing with market abuse in the cryptoasset industry, given the highly globalized, fragmented, and borderless nature of cryptoasset markets.

At the end of the consultation, HM Treasury called for evidence requests to understand potential approaches around DeFi, sustainability reporting, and other cryptoasset activities, such as validation and mining. HM Treasury seeks feedback on DeFi and proposes to issue guidance on DeFi-related activities in the future. On sustainability reporting, HM Treasury seeks feedback on the approach to integrating climate risks into the regulatory framework.

Overall, the consultation aims to establish a coherent and consistent regulatory regime for cryptoassets in the UK financial services sector. It looks like a sensible first step, but the industry will be keen to see detailed secondary legislation and rules that fit within HM Treasury’s core design principles, including maintain proportionality which can provide adequate consumer protection and encourage the development of secure products, such as self-custody wallets.

DCGG Response

We welcome the clear understanding of the market demonstrated by HM Treasury in this consultation document, and recognise that further discussions and consultation with industry will be forthcoming on more specific and appropriate regulations and oversight. In our (lengthy!) response, which you can find in our Consultation Responses section (look for “DCGG Response – HMT Cryptoassets Consultation“), we outlined a set of key points at this stage:

- HM Treasury and the FCA should provide clear definitions and guidance on the cryptoasset services and products that will be captured by future cryptoasset regulations

The definition of cryptoassets is broad in the Financial Services and Markets Bill (FSMB) while there are a complex range of services and products under each economic activity. These may present a different and unique set of risk characteristics that should be considered to avoid overly prescriptive regulations. This should also clarify what specific activities will be captured in different phases of HM Treasury’s proposed approach (e.g., between different types of stablecoins).

- HM Treasury and the FCA should consider developing a digital taxonomy that can be updated to reflect market developments and business models that will be captured by the regulations

As highlighted in one of the FCA’s cryptosprint outputs, a clear and detailed digital taxonomy could help in developing a regime for cryptoassets that is clear and can be updated regularly, enabling regulators to classify cryptoassets and apply relevant rules based on product types, relevant activities, and underlying technology. This will also support timely communication and collaboration with industry on the requirements and timelines, as well as the relevant supervisory oversight body.

- A transition period should be implemented for each phase of the proposed regulations for cryptoassets

This will enable firms and regulators to effectively prepare for the regulatory regime. A set of industry-standards, or participation within a self-regulatory organisation (SRO) could be considered as an interim measure to provide confidence within the market.

- HM Treasury should clarify whether other financial services activities will also be subject to the location-based requirements proposed in this consultation document.

We also encourage further exemptions that recognise the unique digital nature of digital asset platforms, and that provide for further alignment to competing proposed international frameworks, by accommodating for Reverse Solicitation and the Overseas Persons Exemption that should apply to any location-based requirements facing the cryptoasset sector.

- Hardware self-custody wallet providers should not be subjected to the same regulations proposed in this document as software wallet solutions that have access to client keys and accounts

This will encourage the development of safer consumer products that are more akin to physical wallets. The list of activities and services that will be captured within the regulatory scope should be well defined via secondary legislation, rulebooks, and a digital taxonomy.

- A dual responsibility should be established between trading venues and regulators in defining detailed content requirements for admission/disclosure documents and monitoring of market abuse

We believe establishing greater public-private partnerships will be most effective to ensure best practices are shared across industry and market abuse is managed in the most appropriate way (e.g., regulator publishes public blacklists and encourages use of STORs).

- It would be most effective for the issuer of a cryptoasset to be held liable for the admission disclosure documents for trading venues

As the issuer is most familiar with the cryptoasset, it is sensible that they hold responsibility for ensuring the information provided is accurate. In the event there is no central issuer, we agree liability should sit with the trading venue.

- Any regulatory requirements related to cryptoasset lending should consider the different forms of lending activities and underlying asset used as collateral when defining the scope of covered activities in this product category, and the resulting requirements therein.

As an example, it would be most effective for the regulatory regime for peer-to-peer cryptoasset lending to draw from the existing peer-to-peer lending regime. DeFi liquidity provision is more difficult to regulate at this stage and the Government would benefit from ongoing monitoring and promoting international dialogue. Other forms of cryptoasset lending could draw from more traditional lending regulatory regimes.

It is important that the applicable requirements and rules facing lenders consider the volatility of the underlying asset. Stablecoins, for example, present significantly less volatility risk than other unbacked exchange tokens where more burdensome prudential and regulatory requirements would be more appropriate in promoting consumer safety.

- ‘Staking’ should be further differentiated between ‘staking to secure blockchain networks’ (e.g., layer 1) and ‘staking to provide provision of DeFi liquidity’

These are two separate forms of staking with completely different risk characteristics and purposes. We believe the Government and regulator should recognise this by applying light-touch regulation to the first form, given the security and safety it provides, and the second form which is inherently riskier given this form of activity is more vulnerable to hacks and exploitation, as well as impermanent loss and market volatility which may cause additional investment risk for the consumer. However, given the cross-border nature of DeFi, we encourage coordinating international dialogue on how regulations could best apply.

- DeFi and validators should not be subject to regulation at this stage. Centralised on/off exchanges are the best first step towards regulating DeFi, although further consultation and international dialogue is required

We believe regulating validators at this stage would prove to be ineffective and potentially promote regulatory arbitrage, weakening the UK’s overall competitiveness. Regulating DeFi in general will take more time, and the Government would benefit from ongoing and additional monitoring of the DeFi industry as well as promoting further dialogue with industry.

Next Steps

We look forward to reviewing HM Treasury’s response to the consultation and submitting responses to future consultations on the design of the regulatory regime for cryptoassets. There is a real opportunity for the UK to harness the benefits of the sector and technology.

If anyone is interested in discussing this, or DCGG in more detail please reach out to [email protected]